The Regulatory Trinity

In 2008, an anonymous computer scientist named Satoshi Nakamoto proposed a new peer-to-peer electronic cash system called Bitcoin. In the years since, Web3 has persistently found itself at the forefront of financial innovation around the globe. The contemporary blockchain landscape is primarily bent on challenging and changing traditional finance, or TradFi. While its practical applications have shown great potential, it still remains a remix of this traditional financial system - albeit one dedicated to improving the efficiency and fairness of the former's now-outmoded paradigm.

Introduction: DeFi as the beating heart of Web3

In 2008, an anonymous computer scientist named Satoshi Nakamoto proposed a new peer-to-peer electronic cash system called Bitcoin. In the years since, Web3 has persistently found itself at the forefront of financial innovation around the globe. The contemporary blockchain landscape is primarily bent on challenging and changing traditional finance, or TradFi. While its practical applications have shown great potential, it still remains a remix of this traditional financial system - albeit one dedicated to improving the efficiency and fairness of the former's now-outmoded paradigm.

Distributed technologies represent a revolutionary reimagining of the outdated mainframe-powered financial systems of the past. However, like its TradFi predecessors, web3 remains subject to a predefined set of regulatory restrictions and goals imposed by existing institutions. In this set of articles, we will demonstrate that web3 operates within a trinity of regulatory goals, including laws focused on anti-money laundering (AML), securities and commodities regulations, and edicts that define the broad framework for market infrastructure.

The Trinity

While some of these regulations are written in a way that is purposely complex, their essence is simple, and their intent (for the most part) is driven by noble aspirations. Despite their Gordian intricacies, these regulations serve to ensure the integrity of financial systems and protect investors, customers, and other stakeholders from fraud and abuse.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws aim to prevent bad actors from profiting from nefarious activities. These laws are undoubtedly beneficial to society as a whole. However, there is reason to believe that, as currently designed and implemented, they are largely ineffective and inefficient.

Securities and commodities laws are designed to protect investors from scams and manipulation that are all too common when fundraising for a 'common enterprise' or trading shares of such enterprises on secondary markets. The benevolent intent behind these laws is clear. As such, it is difficult to argue against the benefits that web3 would reap if there were less fraud and deception in the space. Imagine the potential of web3's unique technology stack if developers and end users no longer had to worry about bad actors misusing it at no cost to themselves.

Market infrastructure regulation ensures that intermediaries facilitating access to financial markets and services operate in a manner that promotes market efficiency and treats all parties equally. This regulatory framework serves the greater good of capitalism, ensuring that the financial system operates in a fair and efficient manner. However, despite the intent behind these regulations, their implementation in practice has often fallen short, resulting in a track record of non-compliance and inefficiency. In many cases the root causes of reduced effectiveness of market infrastructure regulations lie in inherent lack of transparency that characterizes TradFi systems, lack of transparency that web3 has been created to ameliorate.

Delivering regulatory clarity for digital assets is a challenging process that has extended over two decades. We can largely attribute the core issues to two pillars:

One of the most pressing challenges regulators face is the categorization of digital assets. Are they commodities, securities, or do they fall under an entirely new category? Digital tokens often exhibit characteristics of one, both, or neither, creating a significant dilemma.

The problem of tailoring complex regulations to a rapidly evolving industry built upon fast paced innovation which presents a moving target for regulatory authorities. Web3 promises a leap in human progress comparable to that of the internet itself. The pace of innovation far outstrips the rate at which slow and sophisticated TradFi regulatory frameworks can adapt. National authorities aim to establish regulations that are robust enough to prevent misconduct and protect stakeholders, yet flexible enough to accommodate the advancements promised by this burgeoning industry. The global nature of these burgeoning technologies cannot be ring-fenced or sandboxed by any given regulatory authority, creating a tale of unstoppable force and immovable object in action.

Contemporary Web3 - a parody of it's own foundational ideals

As a result, despite its foundational ideals of democratization and decentralization, the web3 space often resembles a "glorified casino," characterized by high-stakes speculation, significant risk, and ill-prepared 'next billion' lured in solely by the potential for substantial reward - another 1000x gem, which more often than not will appear a delusion post factum. But, as always, when it's clear, it's also too late.

The combination of delayed regulatory clarity, pseudonymity, and rapid advancements in decentralized finance (DeFi) and non-fungible tokens (NFTs), along with an unprecedented wave of central bank liquidity and a large amount of capital being deployed by echelons of risk hungry VCs, has created a bloated, hyper-financialized industry. This has resulted in a paradoxical situation where the industry has burned more of its supposed "next billion users" than it has elevated from poverty. Without effective regulation, the industry risks losing its potential to bring about positive change in the world.

Embracing compromise to sustain Cyber Freedom

Web3's current state of perpetual plutocratic anarchy is unsustainable. Regulators from around the world are taking notice of the "financial wild west," and it is imperative that the industry embraces a number of necessary changes. Fighting these changes will only lead to a dystopian future where thin and unconnected enclaves of "free" cipher capital slowly fade away in a sea of centralized CBDC liquidity. It is essential to work towards a regulatory framework that balances innovation and growth while ensuring compliance and protection for all stakeholders.

As industry participants, we have the responsibility to offer an alternative - a web3 done right. We must develop a tech stack that adheres to the principles of decentralization and sovereignty, while also harnessing the wealth of human knowledge found within existing regulatory statutes. Despite the many flaws of TradFi, including failed controls and often unpunished levels of corruption, it has enabled significant progress and fostered innovation through reactive regulatory measures aimed at limiting abuse and fostering innovation.

The only way to preserve cyber freedom while improving the world is to build at the intersection of web3 tech and TradFi regulation. To better understand how we can accomplish this task, it is essential to have a deep understanding of the regulations themselves: their origins, their current state, and how we can adapt them in a way that supplements a more decentralized world.

Concluding thoughts

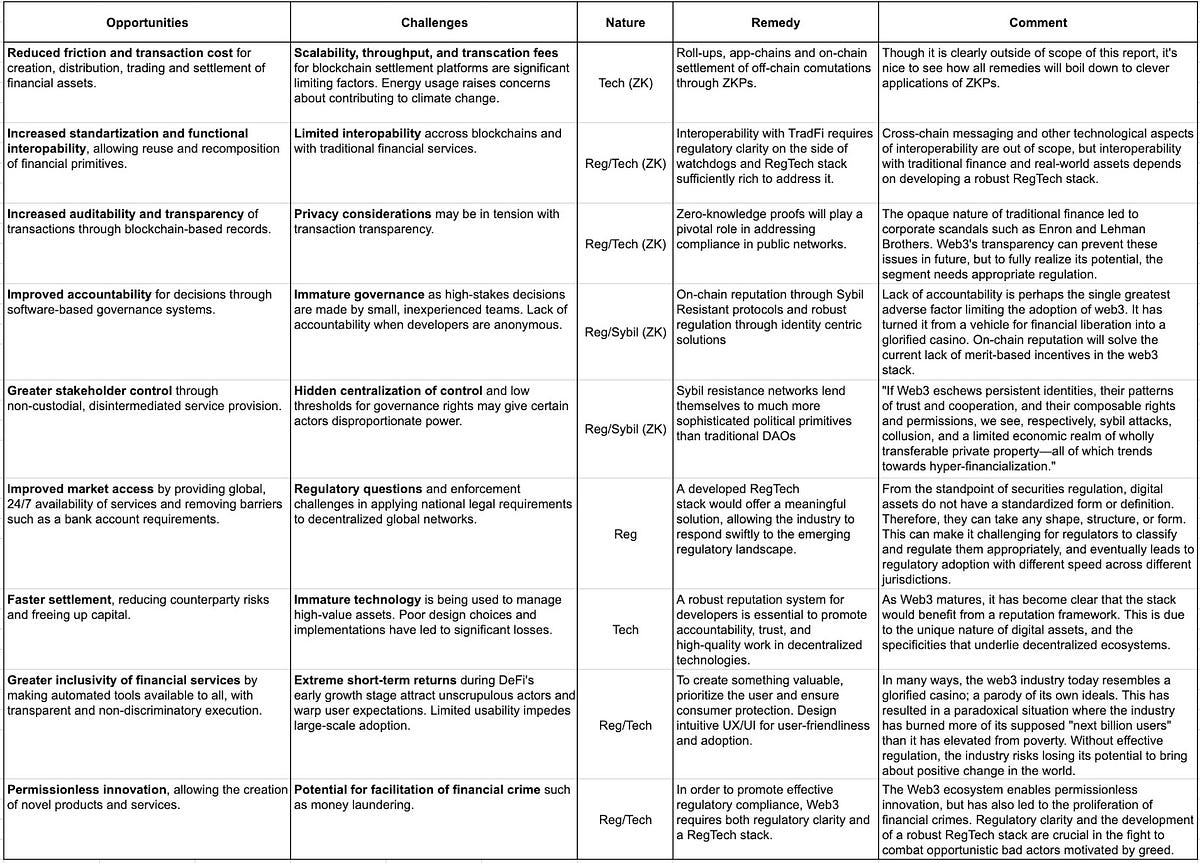

We conclude this introduction with the following table, initially from a remarkable piece "DeFi Beyond the Hype" by Wharton. [2] We have taken liberty to add remedies and commentary. Here we see the opportunities and challenges of implementing a compliant middle ground between TradFi and web3. Understanding these opportunities and challenges will enable us to develop strategies and solutions that foster the growth of web3 while adhering to regulatory requirements and ensuring a more inclusive, transparent, and efficient financial future.

Table 1. Opportunities, Challenges of Web3 from Reg/Tech Perspective

Source:Defi Beyond The Hypeand authors own compilation

A better web3 would foster an environment where opportunities can flourish, taking advantage of the vast innovative potential that the space offers. At the same time, the industry should take responsibility for mitigating consumer challenges by prioritizing its own self-regulation. This would ensure that future iterations of web3 technologies operate in a compliant and sustainable manner.

In pursuit of a balanced approach, our objective does not lie in advocating for censorship or exclusivity. Instead, we strive to identify middle ground solutions that enable the web3 community to uphold its principles while harnessing the immense potential of the web3 technological framework to bring about positive and far-reaching transformations for humanity worldwide.