Real World Assets: The Emerging Paradigm For Web3

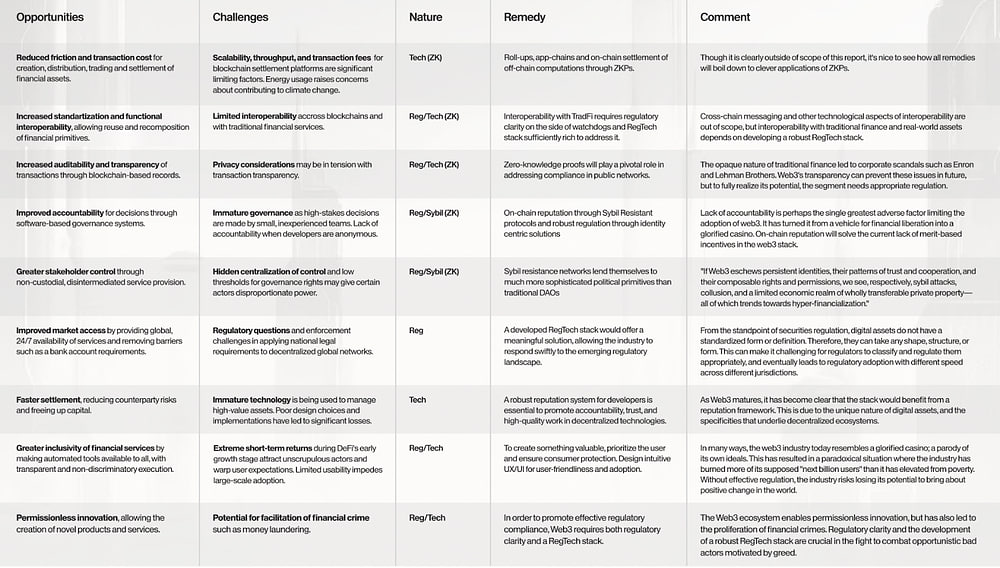

This research delves into the present landscape of Real World Asset (RWA) tokenization, its implications for the Web3 sector, and the challenges still on the way, such as the need for a robust RegTech stack in the permissionless blockchain systems. We have outlined the opportunities and the challenges of integrating Web3 stack with the broader FinTech landscape in our first article of the Regulatory Trinity series [1], Table 1 provides a summary. The current research encompasses a case study outlining the compliant privacy primitives of Galactica Network. Prior to reading the article, we encourages a reader to review the follow chart before proceeding.

Introduction

Below is a research piece, delving into the present landscape of Real World Asset (RWA) tokenization, its implications for the Web3 sector, and the challenges still on the way, such as the need for a robust RegTech stack in the permissionless blockchain systems. We have outlined the opportunities and the challenges of integrating Web3 stack with the broader FinTech landscape in our first article of the Regulatory Trinity series [1], Table 1 provides a summary. The current research encompasses a case study outlining the compliant privacy primitives of Galactica Network.

We highly encourage a reader to go over the table below before proceeding.

Table 1: Opportunities, Challenges of Web3 from RegTech Perspective [2]

RWA Potential & The Benefits

RWAs are tangible assets that originate outside of the Web3 ecosystem. Specialists tokenize assets, which enables them to serve many purposes, such as a source of yield, within the Decentralized Finance (DeFi) sector. RWAs include a wide range of traditional assets, including short term treasury bills, commercial real estate, bonds of all sorts, and other articles of value, all of which can be tokenized, utilized in the Web3 ecosystem (e.g. in DeFi protocols) and eventually redeemed.

The integration of RWAs is a pivotal step forward for DeFi. It opens up opportunities for participants in the space to tap into the deep pools of TradFi liquidity, new financial instruments enabling better fine tuning of risk/return profiles, and utilitarian value inherent in the traditional, non-digital asset domain, such as real estate, consumer loans and such. To put this into perspective, while the combined market cap of the digital assets space is currently sitting around $2.7 trillion (according to CMC), the traditional financial systems persistently hold assets exceeding US$900 trillion [3].

Therefore, in order for DeFi to profoundly transform the global financial services industry, it is essential to have a functional framework for accessing these immense pools of TradFi liquidity.

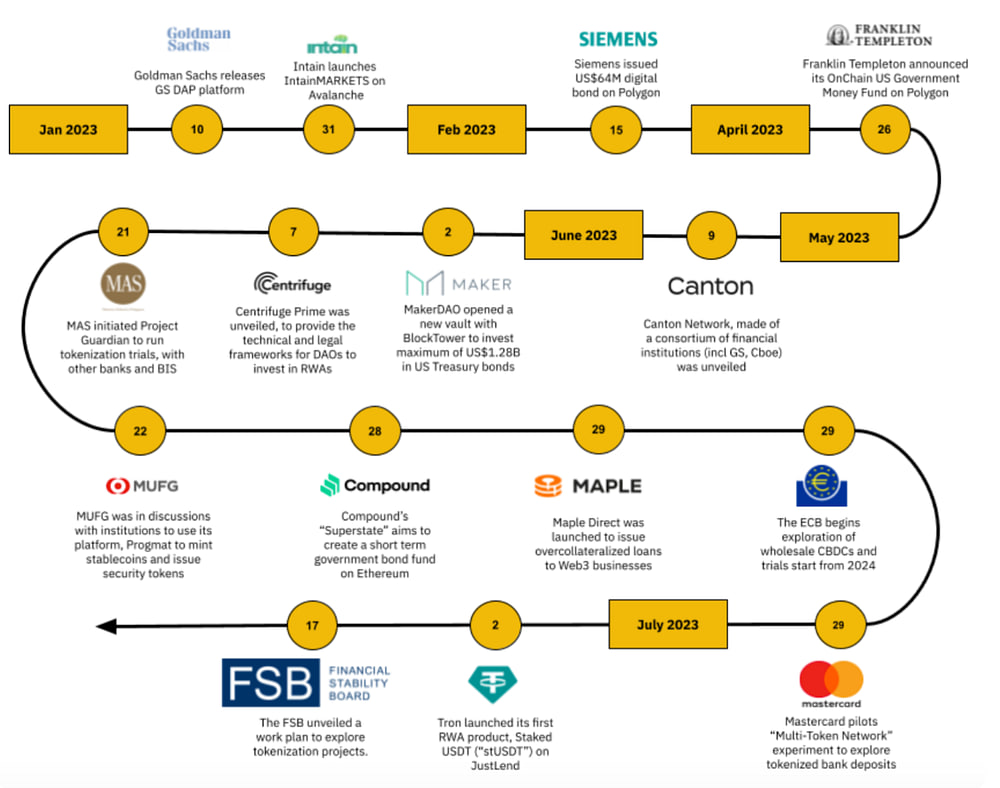

Alongside DeFi protocols, TradFi sectors are increasingly recognizing the potential impact of the RWA and Web3 fusion. Over the past few years, several institutions have started to explore the development of proprietary blockchain systems for tokenizing assets.

Case in point - institutions like Goldman Sachs and J.P. Morgan have taken to experimenting with tokenized RWA offerings to achieve cost savings and efficiencies. J.P. Morgan's Onyx Digital Assets team, in collaboration with Apollo Global Management, announced as recently as November 2023 that it intends to develop a proof-of-concept system under Project Guardian to enable fund managers to tokenize funds [4].

Goldman Sachs, through its Digital Asset Platform, has similarly achieved significant savings in digital bond issuances [5]. Broadridge, Equilend, Intain, Vanguard, and Liquid Mortgage are also notable for their developments in leveraging blockchain for asset tokenization and achieving efficiencies in various financial processes, according to reporting by Coindesk [6].

With this trend gaining momentum, it is anticipated that financial institutions will eventually integrate tokenized instruments into their offerings. As the industry matures, regulatory developments will likely be a key catalyst in driving widespread acceptance and adoption of these practices.

Fig. 1: Timeline of institutional adoption and market developments [7]

From the vantage point of Web3 industry participants, the value of widespread RWA integration into, for example, DeFi apps is immediately clear given the Total Addressable Market (TAM) numbers presented above. These vast pools of liquidity, without a doubt, present a transformative opportunity for our young space. But what is it that TradFi institutions see that pushes them to experiment with DLT infrastructure for tokenizing assets?

It is Web3's superior technological stack that presents a wide variety of benefits for all the participants of the value chain, from originators to secondary market traders.

Some of them include:

Liquidity: Simplified architecture for liquidity provision and end-user access.

Accessibility: Tokenization on blockchain platforms makes traditional assets globally accessible, broadening investor reach.

Transparency: Blockchain ensures a tamper-proof, publicly accessible record of ownership, giving stakeholders clear insight into how tokenized assets are managed and governed.

Settlement efficiency: Faster settlements and lower operational and intermediary costs work to streamline transaction processes.

Composability: Tokenized assets offer versatility, usable across various services within the same blockchain network. For example, a tokenized security can serve as collateral in a lending market, or provide liquidity in a decentralized exchange.

Interoperability: Seamless transfer of assets and data across different blockchains if, for example, two banks decide to use distinct blockchains, for example, Ethereum and Polygon respectively.

Total Addressable Market

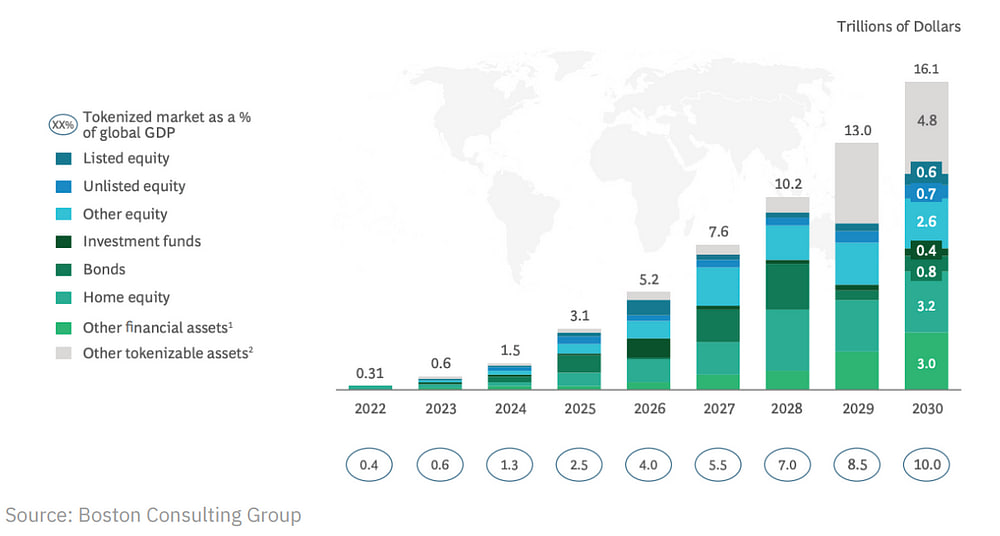

According to a Boston Consulting Group report, the market for tokenized assets is projected to reach $16 trillion by 2030 [3]. This includes tokenizing assets already on the blockchain and fractionalizing traditional assets like exchange-traded funds (ETFs) and real estate investment trusts.

Fig. 2: The tokenization of illiquid assets is estimated to be a US$16T business opportunity by 2030 [3]

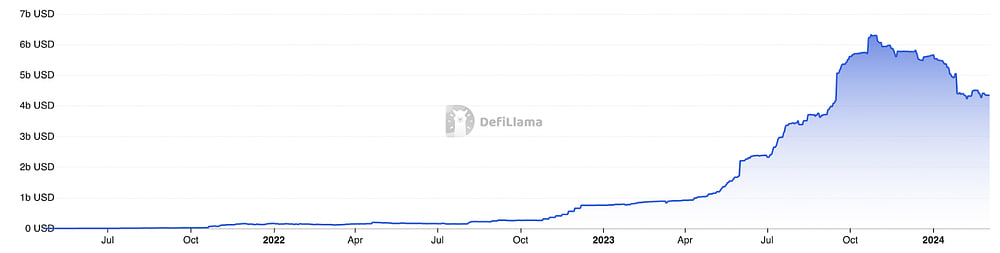

Even with the impressive projection of $16 trillion, tokenized assets will still only constitute a small fraction - less than 1.8% - of the global asset value, estimated at $900 trillion. This calculation doesn't factor in the potential growth of the assets' value globally. DeFi users have demonstrated significant interest in tokenization and RWAs, as evidenced by the surge in activity at the beginning of 2023.

Fig. 3: TVL in DeFi Categories Related to Real-World Assets [8]

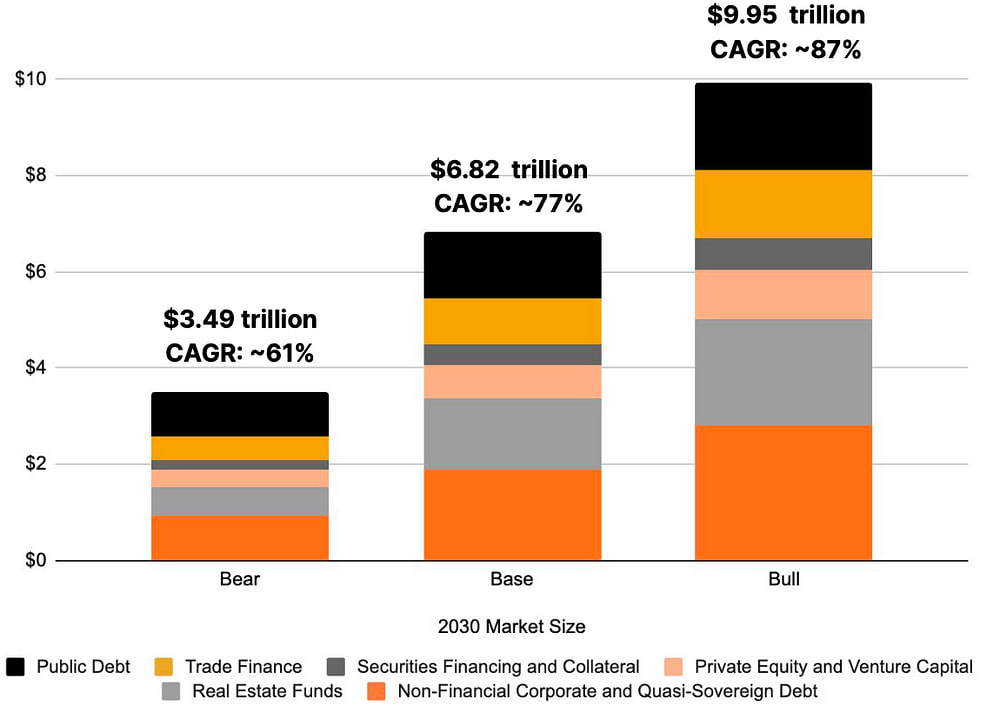

Furthermore, according to 21co's Tokenization Report, the market value for tokenized assets is estimated to vary from $3.5 trillion in a conservative bear-case scenario to as much as $10 trillion in an optimistic bull-case scenario by 2030 [9].

Fig. 4: Tokenization Market Sizing (Oct 2023) [9]

The Current State of RWA in Web3

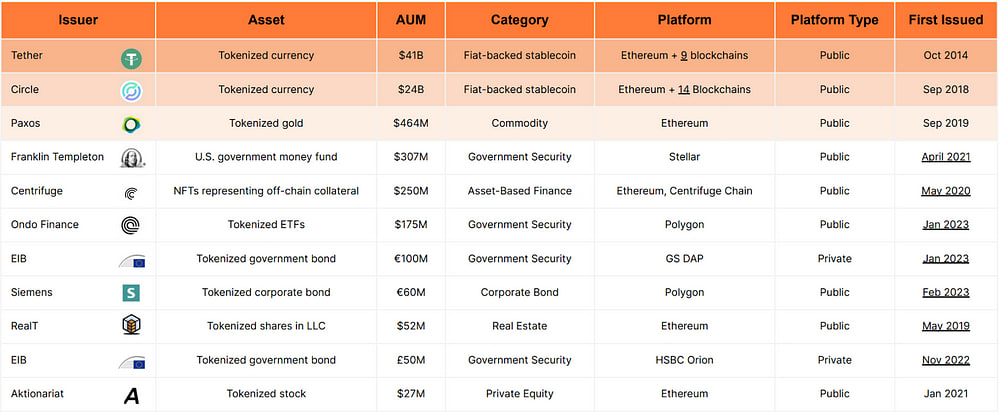

Table 2 illustrates the evolving landscape of asset tokenization. While fiat-backed stablecoins were the initial and most successful application of this financial innovation, its use cases have expanded significantly. A notable development in this expansion is the European Investment Bank's issuance of bonds on a private distributed ledger technology platform.

Table 2: Tokenization examples by issuer, asset type and platform (Oct 2023) [9]

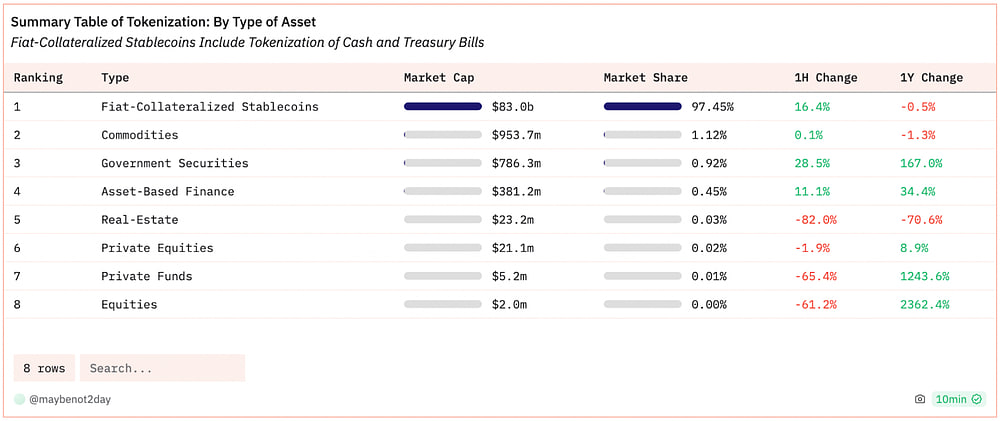

Although significant progress has been made in integrating RWAs on-chain, the current market across public blockchains like Ethereum, Arbitrum, Avalanche, Optimism, and Base is still largely dominated by stablecoins, which make up 97% of the market share (according to 21co). As a result, other asset classes like commodities, corporate bonds, and government securities are significantly less represented in the market.

Table 3: Tokenization: By Type of Asset [10]

Even with the substantial growth in the tokenization of government securities last year and evident interest from both retail and institutional investors, these assets currently represent only 1% of the market. This limited market share is attributed to the lack of regulatory clarity and the absence of a compliance layer, which impedes the full integration of RWAs into the Web3 ecosystem. The Web3 space, evolving alongside a Regulatory Trinity (AML/CFTC, Market Structure, Securities Regulation), often encounters regulations specific to jurisdictions like the EU and the US [1]. Addressing these regulatory challenges is essential for the further development of RWAs in the Web3 space.

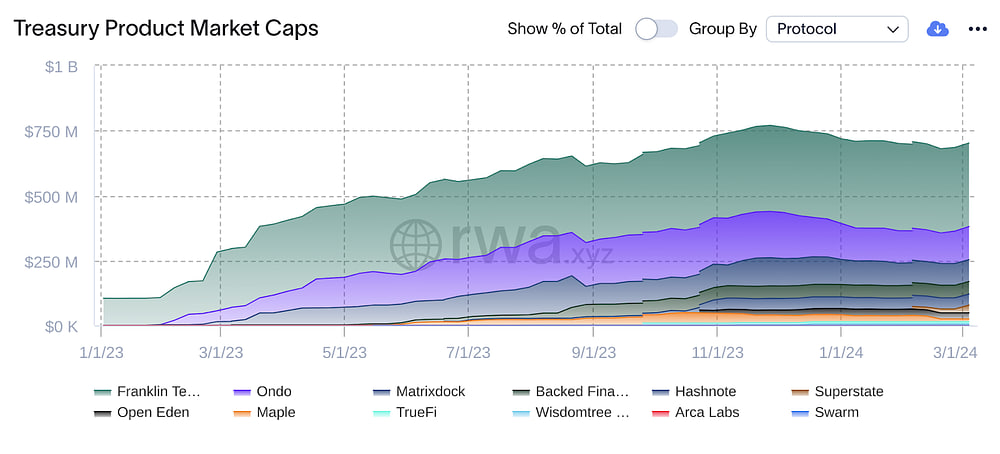

Fig. 5: The tokenized U.S. Treasury market [11]

Challenges

Five key challenges currently confront the tokenization of RWAs:

Legal and regulatory compliance: Establishing a legal framework is crucial to ensure that transferring a token equates to transferring ownership of the underlying asset.

Standardized laws and regulations: How can tokenized securities spanning across multiple jurisdictions operate in a globally compliant manner?

Valuations and audit implications: Implementing a robust price discovery mechanism is necessary so that tokens trade at values close to their intrinsic or nominal worth.

Security and scalability: Public blockchains must demonstrate resilience against cyber-security attacks and scale to the demands of the global financial system.

Collaboration between the multiple key stakeholders: Creating a standard process for on-chain asset integration is vital to minimize human intervention and enhance scalability.

Primitives for Compliant Privacy

When it comes to integrating traditional finance in DeFi, one of the most significant barriers is the lack of a regulatory compliance layer within blockchain protocols. This deficiency is particularly problematic for transferring institutional assets to blockchain platforms. The absence of a compliance framework creates a misalignment between blockchain and existing financial regulations, hindering traditional financial institutions from meaningfully integrating into the DeFi practices.

Regulatory compliance involves rules that prohibit/regulate products and practices. It serves a protective function but can also be invasive. People dislike the invasive aspect until major crises hit, highlighting the need for protection. Examples abound: from hit and run IDOs to major crises like FTX collapse, we all would benefit from a more mature regulatory framework.

Any regulatory regime must hit an intricate balance between privacy and compliance.

Traditional finance systems and distributed ledgers must converge for effective interaction and adoption, but this technological and regulatory convergence requires compromise. Applying TradFi regulations to Web3 directly won't work due to incompatible ethos and tech stacks, while lack of regulation hinders adoption [12].

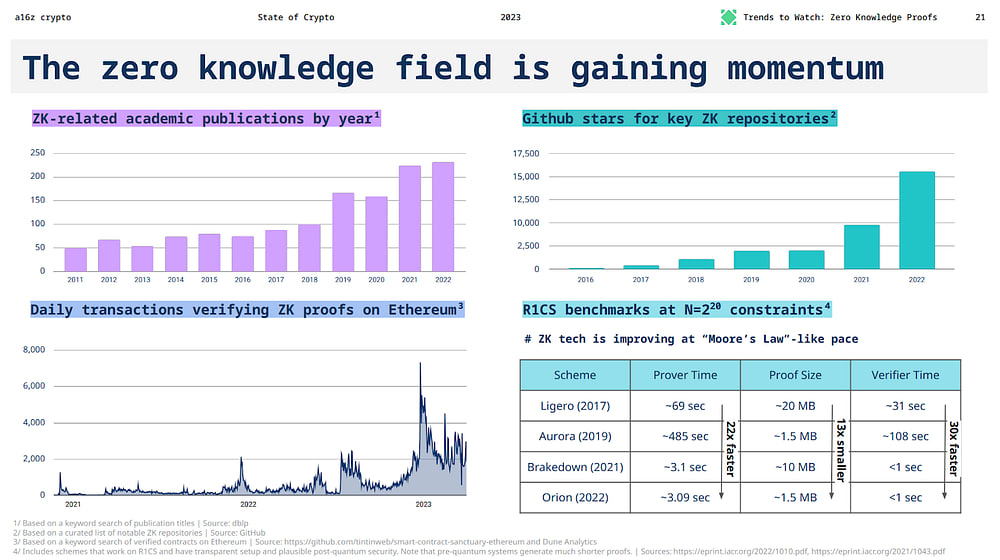

The most promising solution at present involves the application of the rapidly evolving technological stack around Zero-Knowledge Proofs (ZK). These arcane cryptographic primitives enable proofs over financial and otherwise sensitive data without having to reveal the data itself. They enable data sovereignty and compliance without compromise.

ZK technology streamlines processes such as Know-Your-Customer (KYC) and Anti-Money Laundering (AML), offering a framework that, among other things, might just solve for the missing component of regulatory trinity. Furthermore, it offers a stack capable of uniquely blending privacy requirements of public blockchains and the stringent demands of regulatory compliance.

The increasing recognition and adoption of ZK technology by both Web3 and traditional institutions highlight its potential as a key enabler in shaping the future of finance.

Fig. 6: State of ZK according to a16z [13]

Galactica Network's identity stack is well positioned to, among other things, streamline the integration of RWAs onto blockchains. It provides an effective compliance layer, while ensuring users' privacy.

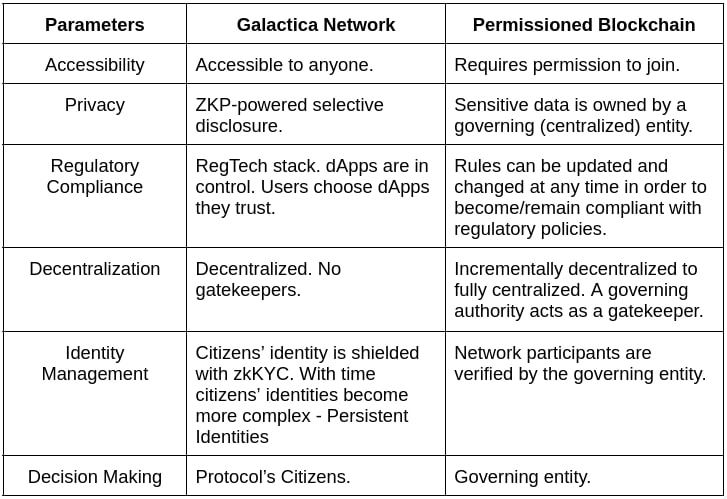

Galactica vs Permissioned Blockchains

Before delving into the benefits of tokenization on Galactica Network, it is pertinent to understand its advantages over permissioned blockchains. The thing is that the problem of KYC compliance has been long solved by projects (such as those Goldman and JPM-sponsored projects mentioned in the introduction) who build centralized KYC processes into the core of their respective blockchain platforms. Such blockchain protocols possess most if not all of the technological benefits of decentralized Web3 platforms, however, they are built on the inverse foundational principles. They are also known as Permissioned Blockchain Protocols.

Galactica.com has been designed and built with the idea of enabling RegTech applications while retaining the ethos of Web3.

Often viewed by traditional investors and regulators as a more secure option compared to permissionless networks, permissioned blockchains are fundamentally different.

Table 4 highlights key differences.

Table 4: Differences between Galactica Network and Permissioned Blockchains

As noted in the introduction for the integration of RWAs into DeFi, there's a clear need for a RegTech stack that could comply with regulations across various jurisdictions. Let's outline key Galactica Network features that are stepping stones towards meeting that need:

zkKYC: Linked to the concept of Galactica Network Citizenship, this feature verifies that users are over 18 and not from sanctioned countries, addressing compliance while protecting privacy and personal data security. It expands users' Web3 Footprint and Persistent Identities, enhancing Sybil resistance.

Contingent Transactions: This feature, effectively a dynamic whitelisting mechanism, ensures dApps comply with defined regulations. It effectively tailors user/liquidity compliance profiles within dApps. For instance, a zkCertificate (e.g. zkKYC issued on-chain) could be used to confirm a user's age and accredited investor status within the U.S., but these contingent transactions make sure only users satisfying this criteria can interact with the dApp and at which terms.

Further details on these concepts are available in the respective sections of the Galactica Network Whitepaper.

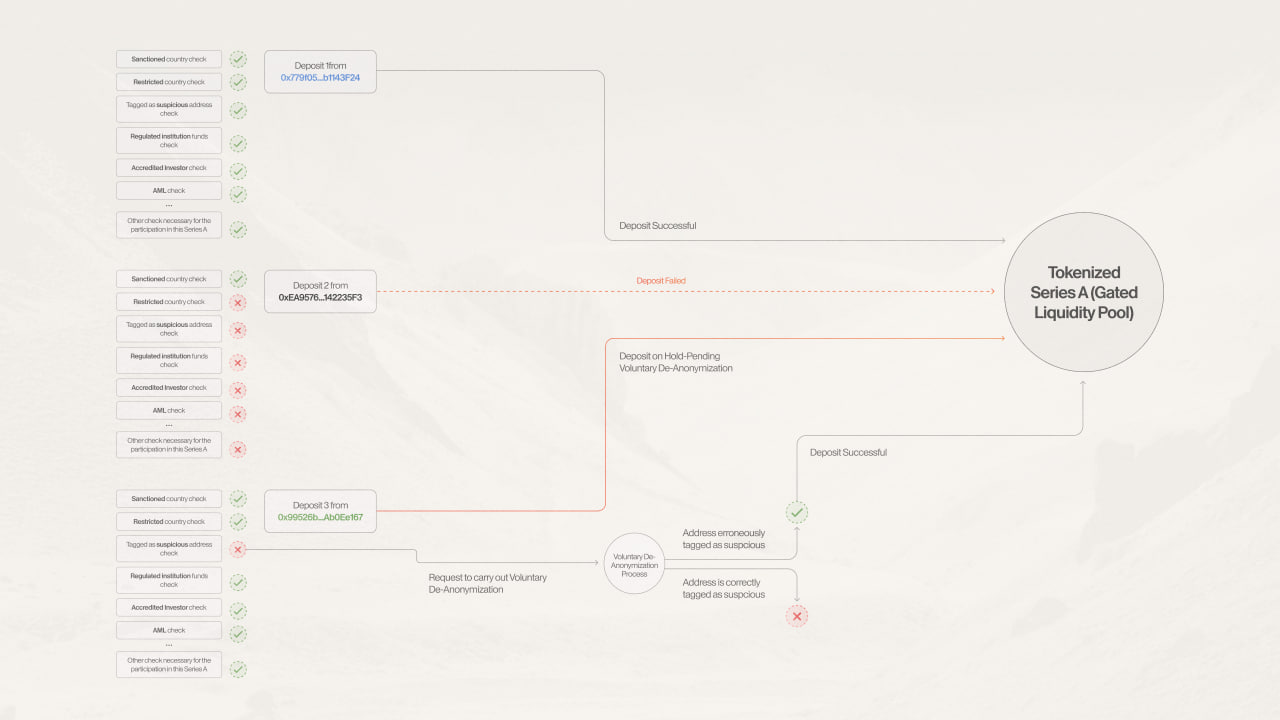

Figure 7 illustrates how these features could be operationalized, using a simplified example of a Gated Liquidity Pool deployed on the network.

Fig.7: Interaction between users and a Gated Liquidity Pool deployed on Galactica Network

Gated Liquidity Pool - a pool that is set up, in Galactica Network, in a way to satisfy certain regulatory requirements required to carry out tokenized Series A funding round, while preserving user privacy. In this vein, a number of conditions must be satisfied in order for a deposit to be successful. Note that this pool implicitly requires the user to have obtained their zkKYC and the list of requirements is for illustrative purposes.

Deposits 1 is successful as it fully satisfies the list of requirements.

Deposit 2 fails as the address used does not satisfy nearly any of the requirements posed by the pool creator.

Deposit 3 fails temporarily as the address was tagged as suspicious. The user may attempt to resolve the issue through Voluntary De-Anonymization to prove that no suspicious activity was carried out by the address in that time.

Overall, Galactica Network's technological advancements enable the RegTech stack that itself makes the following possible:

Security tokens issued by licensed entities accessible directly in permissionless dApps just like your tokens on Uniswap.

Primary and Spot markets for:

a. Real World Physical Assets

b. Financial Assets

c. Hybrid AssetsMerging of Web3 efficiency and TradFi asset diversity, regulation, and liquidity.

Automated compliance proofs for on-chain transactions massively reducing AML costs.

zkCertificate interoperability that has a potential to massively reduce the cost of compliance for businesses.

Privacy pools and more advanced forms of compliant financial privacy: compliant programmable mixers, such as Aztech protocol.

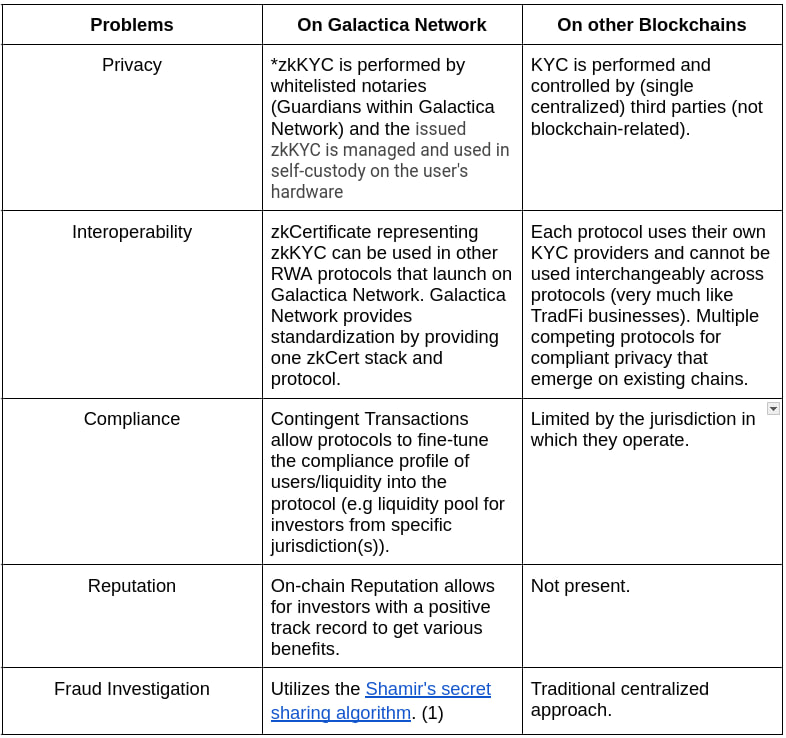

In conclusion to this article, Table 5 below compares how RWA protocols, for example Ondo Finance and Centrifuge, would look like if they were launched on Galactica Network.

(1); Table 5: How Galactica Network enhances RWA protocols

Galactica Network, enhanced by on-chain primitives, enables private yet compliant interaction with RWAs, allowing both TradFi investors and Web3 users to get exposure to this type of assets. Such a possibility will accelerate the integration of RWAs in DeFi and ultimately set the path forward for the effective merging between TradFi & DeFi.